Asset depreciation has been reworked in Calem Enterprise R11. It supports three depreciation methods and annual reporting.

Here are the key fields to configure in an asset for depreciation reporting.

- An asset can be excluded from depreciation by setting its flag: "No Depreciation"

- Original and end values define the starting and ending values before and after all deprecation are counted.

- Depreciation start date and life-span in years define how many years assets will be depreciated.

- Depreciation method determines how assets are depreciated. The methods supported include:

- Straight Line

- Double-Declining

- Sum of Years

- Other – depreciation is not calculated by Calem

- See https://www.wikihow.com/Calculate-Depreciation-on-Fixed-Assets for more info about depreciation methods.

Depreciation Reporting

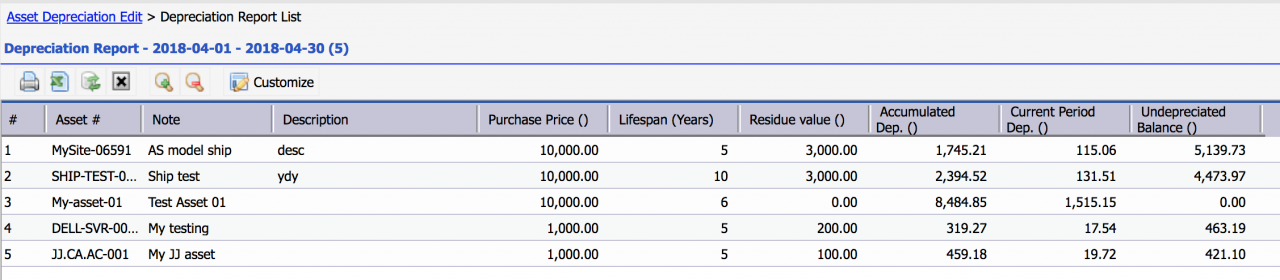

Depreciation reports show depreciation based on the report date range.

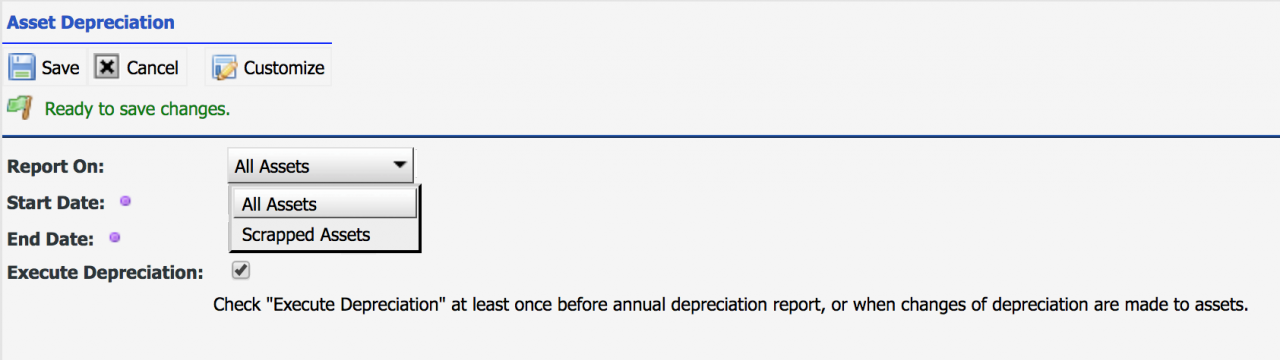

- Check "Execute Depreciation" to recalculate depreciation. This should be done at least once prior to your running a depreciation report, or when depreciation parameters are updated for assets.

- Start time: the start time of the depreciation

- End time: the end time of the depreciation

- The depreciation is calculated pro-rated by year and days. For instance, the depreciation from 12/10/17 to 2/10/18 includes pro-rated depreciation from 12/10/17 to 12/31/17 for 2017, and depreciation from 1/1/18 to 2/10/18 for 2018.

- Reporting on All Assets – shows all the assets with depreciation in the period of time

- Reporting on Scrapped Assets –

shows scrapped assets in the reporting time with dates scrapped.

- If an asset is no longer used during its lifespan its status should be changed to "Scrapped" to tell Calem that the asset is no longer in service and should realize all remaining depreciation immediately.

Assets Added

A list report is available in R11a to show assets deployed in a time period.

- Menu path: Asset module | Report | Assets Added

- Select a period of time to run the report

- You may customize the list view to add or remove fields.

Additional resources

- User Guide and Admin Guide (customer account required)

- Calem Enterprise Training Site

- Calem Enterprise Blogs

- Calem Enterprise demo