Calem Blogs

How to Handle Freight and Tax in Inventory Receiving

Freight and tax incurred in purchasing spare parts should be included in the cost of spare parts to keep maintenance cost accurate. This blog discusses the two processes for handling the freight and tax when receiving inventory ordered by PO.

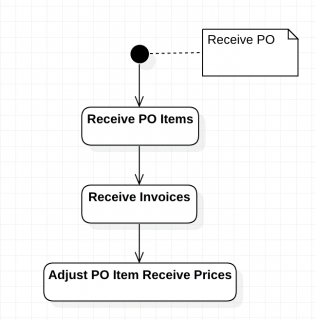

1. Receiving with Invoices

This process covers the cases that invoices are available prior to receiving parts to inventory. It is a new feature that allows you to distribute freight/tax among all PO items by cost.

- Add freight and tax to the PO.

- It is possible to adjust item total. This option is hidden out of the box.

- The freight and tax cost will be distributed to PO items as extended unit prices based on PO item cost.

- The extended unit prices will be used to receiving parts

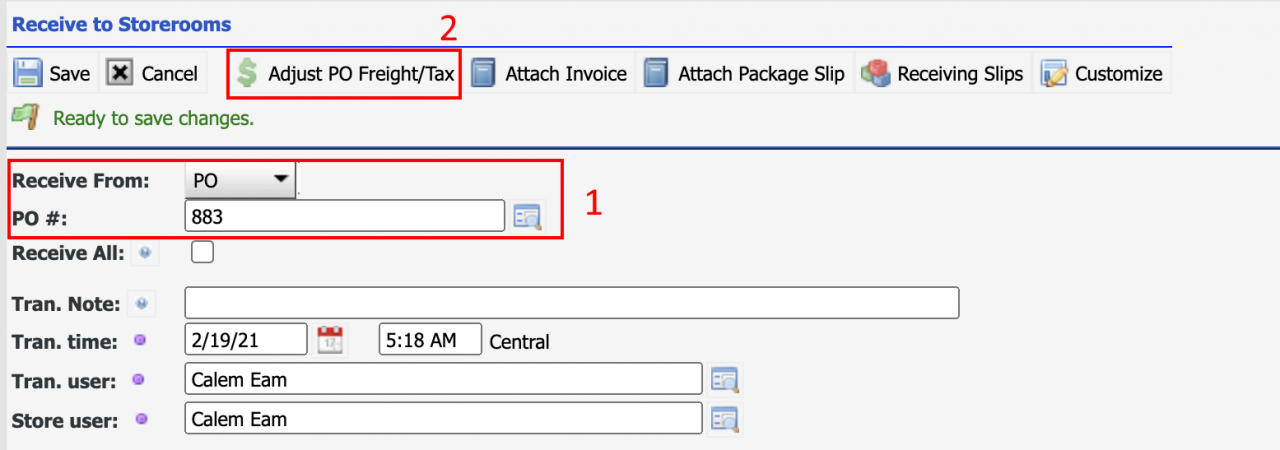

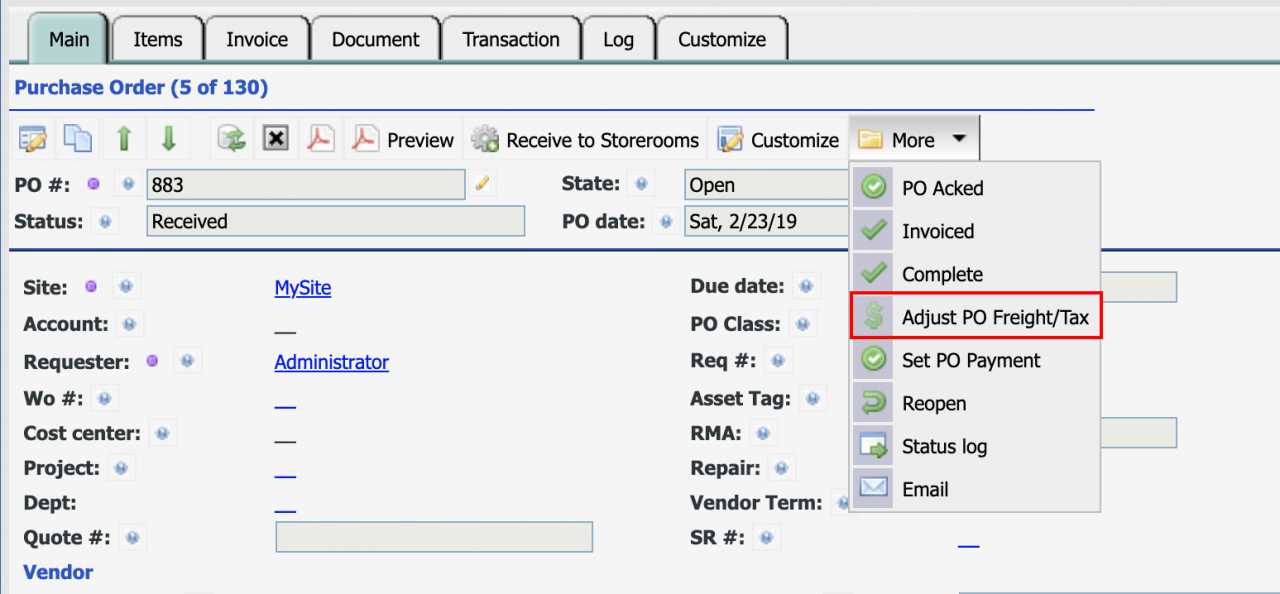

Use menu path "Inventory | Transactions | Receive to Storerooms" to launch the process to receive from PO. Select PO to receive, then click "Adjust PO Freight/Tax" to launch the process.

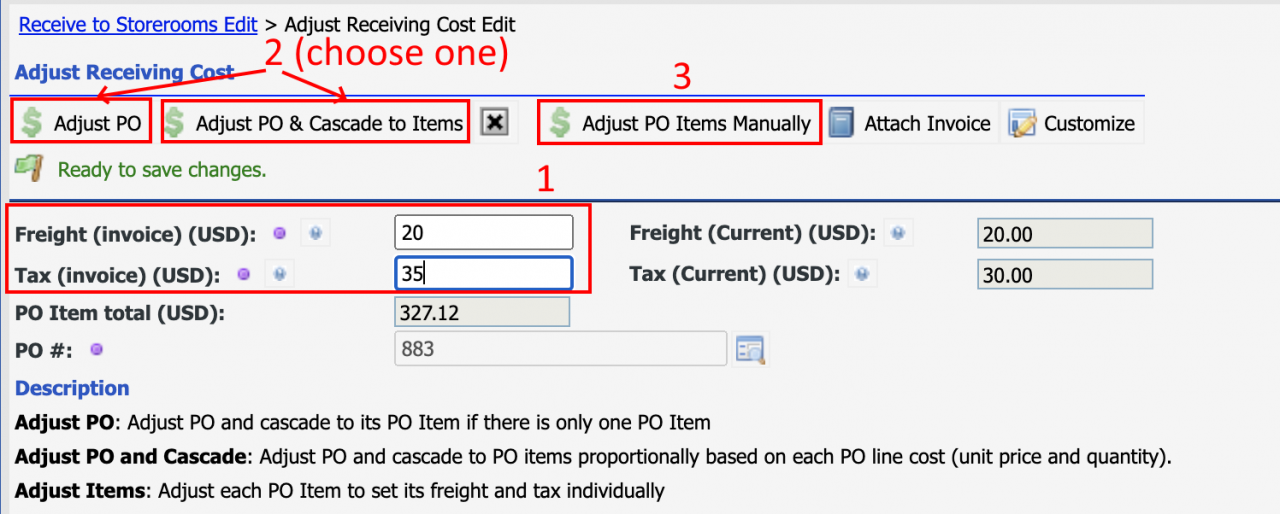

Enter both Freight and Tax first.

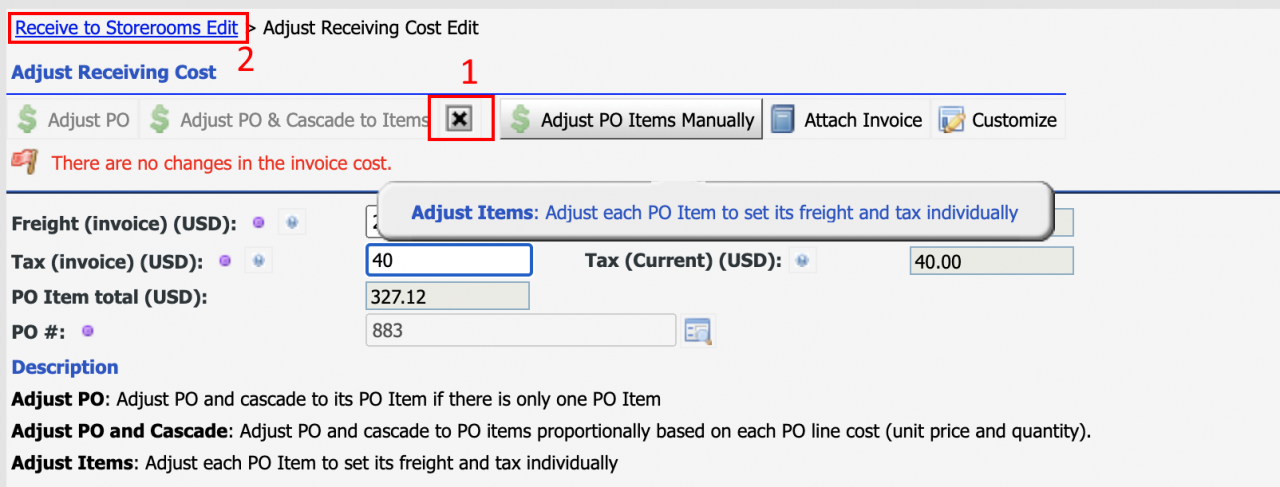

- Use "Adjust PO" to set freight and tax on PO. It there is only one PO item, the freight/tax will be distributes to the PO item.

- If there are more than one PO item in the PO, Calem will prompt you that the PO items are not updated. Use "Adjust PO Items Manually", or "Adjust PO& Cascade to Items" to distribute freight and tax to each PO line.

- Use "Adjust PO & Cascade to Items" to set Freight and tax on PO, and cascade the changes to PO items proportionally by PO item costs. For instance, the cost of PO line 1 and 2 are $100 and $200 respectively, PO line 1 receives 1/3 of the freight and tax cost; while PO line 2 receives 2/3. The distributed freight and tax will be divided by PO line quantity and added to unit price ("Ext. Unit Price" field).

- When a PO item's "Ext. Unit Price" is updated, and there are transactions received previously, those transactions will be adjusted to the new "Ext. Unit Price".

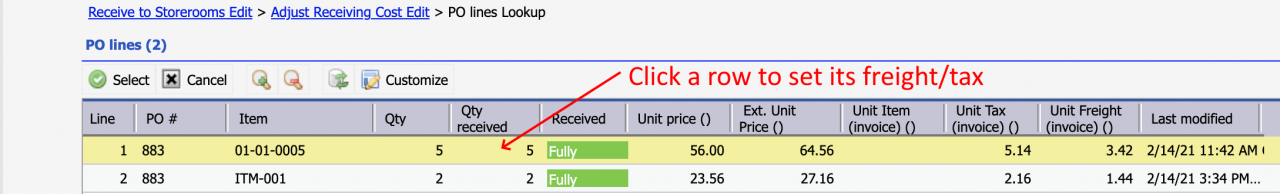

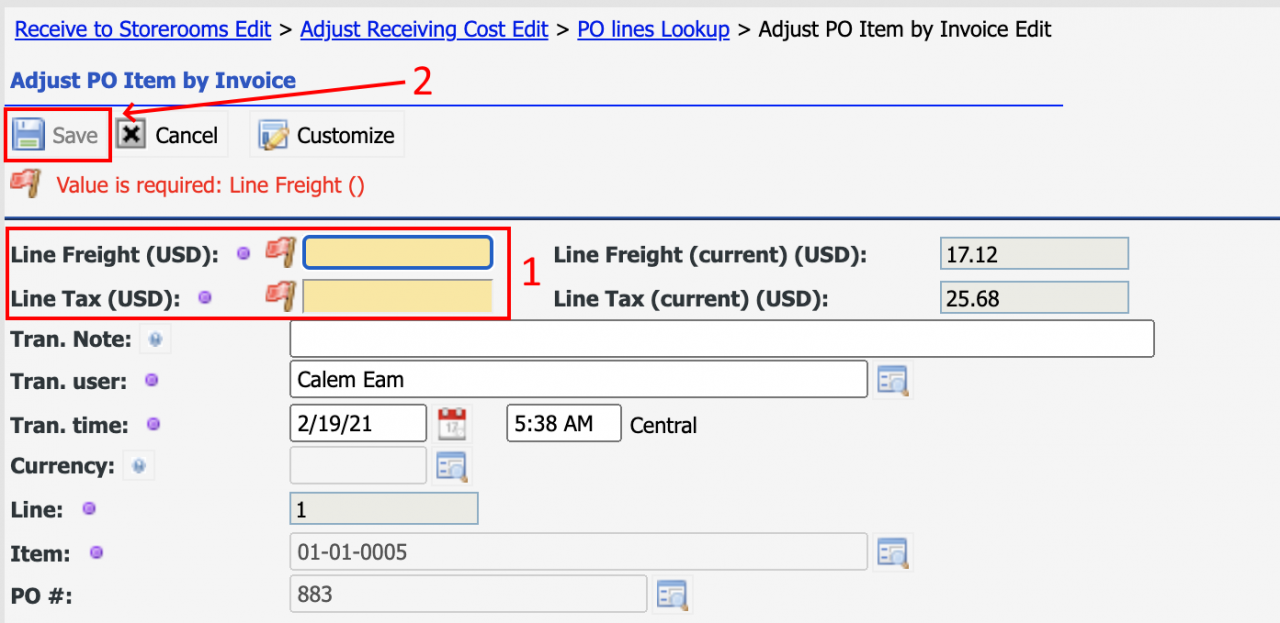

- Use menu "Adjust PO Items Manually" to distribute freight/tax to each PO line manually. The list of PO items are shown, click a row to proceed. Set freight and tax for a line and click "Save" to complete.

When you are done with freight/tax adjustment, click the "Close" (x button) or the breadcrumb to go back to the receive screen to continue.

2. Receive without Invoices

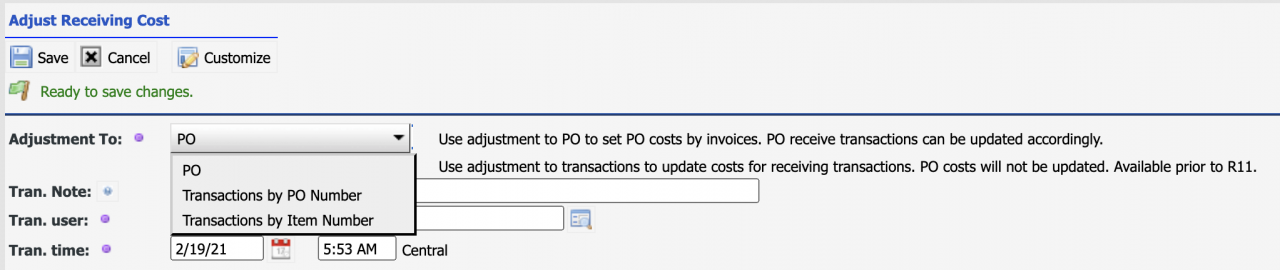

This process covers the cases when parts arrive without invoices. These parts are received with PO unit prices. When the invoices are available, use transaction "Inventory | Transactions | Adjust Receiving Cost" to add freight and tax.

The adjustment process allows you to adjust the PO as discussed above, or adjust selective receiving transactions one at a time.

A convenience menu is made available to launch the freight/tax process from a PO screen.

Additional Resources

By accepting you will be accessing a service provided by a third-party external to https://calemeam.com/