Calem Blogs

Blogs of CalemEAM

How to Set Up Vendor Tax Codes

Vendor tax codes have been improved in Calem Enterprise R2019a. It supports single site and multiple sites deployment.

- A default tax code can be configured at vendor or vendor site. The tax code will be used as default tax code for the vendor and vendor site.

- A site specific tax code can be configured for a vendor site. This setup is useful for multi-site use. One site may have a tax code for a vendor, another site may have another tax code for the same vendor.

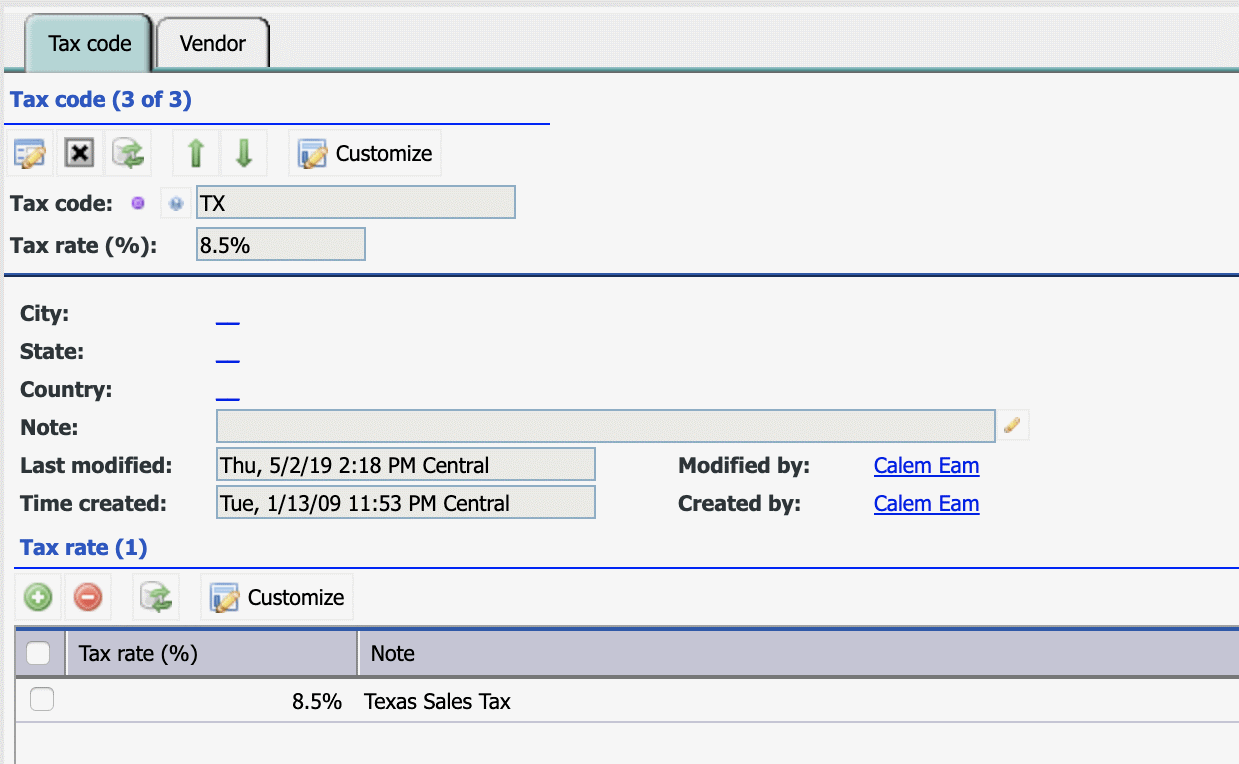

Step 1. Tax Code

Tax codes can be configured at purchase module:

- Purchase module | Open | Tax Code

- A tax code may include different tax rates.

Step 2. Vendor Tax Code

Set up vendor tax codes at vendor. The tax code will be used for the vendor and vendor site unless a site specific tax code is defined.

- Organization module | Open | Vendor

3. Site-Specific Tax Code

This step is necessary if you have sites located in different tax codes.

- Purchase module | Open | Tax Code | Vendor Tab. Add vendor site and site to use the tax code.

4. Bulk Upload Tax Code

You can use excel template to bulk upload tax codes. Both reports below can be used to upload tax codes.

- Organization module | Report | Company Listing (Vendor/Manufacturer). Customize the report to include "Tax Code" column. Export the report. Populate the tax codes and upload.

- Alternatively, use report "Purchase module | report | Vendor Taxes" to export to an excel file. Fill out the vendor site and tax codes and upload. For site specific tax codes, fill out vendor site, site and tax codes, then upload.

Additional resources

By accepting you will be accessing a service provided by a third-party external to https://calemeam.com/